As we discussed in our previous post Why Brands Need to Protect Exclusive Offers, exclusive offers are emerging as a cost-effective digital marketing technique to drive acquisition of target groups like teachers, students and members of the military.

According to recent survey results, 94% of Americans say they would take advantage of an exclusive offer. But to be successful with exclusive offers, brands need to be vigilant about data privacy. 83% of Americans have concerns with the types of data that would be collected, and nearly three quarters of shoppers (73%) believe brands use personal information without their knowledge when verifying a consumer for an offer.

Retailers who can meet consumer demands for how data is collected and verified will gain a competitive advantage that’s untouchable by brands who fail to listen to their customers.

But the question remains: what’s the best way to make exclusive offers work for both consumers and your business?

How Consumers Want Brands to Verify Exclusive Offers

Easing consumer concern around exclusive offers comes down to a brand’s ability to establish customer relationships built on integrity. Here are four steps you can take to create an exclusive offer program that shoppers prefer – one built on a process that meets consumer expectations while simultaneously driving conversions and loyalty.

- Give shoppers control of their data.

In the aftermath of the Cambridge Analytica data scandal, consumers are cautious. Only 8% of consumers want you to use data such as social media likes and clickstream behavior, and only 17% want you to use clickstream behavior from their website. Most compelling, by a margin of 2:1, consumers want to be able to opt in to an offer before providing personal data.

With opt-in, or “consent-based,” models like exclusive offers, consumers have the opportunity to decide when to engage with you and what information they want to share in exchange for access to your products, services, information – and discounts. A brand also benefits. You’ll get even more traction by inviting shoppers to take advantage of selective discounts available to only their community, rather than bombarding them with intrusive hit-or-miss campaigns.

- Apply discounts immediately.

When it comes to verifying exclusive offers, Americans want instant gratification. Forty-seven percent won’t wait more than a minute to be verified for a low-cost item, such as a movie ticket; and over one in four (26%) expect to be verified for expensive items, such as a television, within a minute or else they’ll abandon the offer.

When choosing a solution, make sure it has a broad data set to verify buyers instantly, and that the vendor can follow up and verify through a document review in just a few minutes, if eligibility can’t be immediately confirmed.

Digital verification is far better than manually verifying eligibility yourself, which can take even more time and increase friction in the customer experience. Manual verification also often fails to catch rampant fraudulent behavior. When we audited our customers, we found fraudulent transactions were as high as 35%. And 1 in 3 Americans who redeemed an exclusive offer admitted they didn’t qualify for it.

- Avoid collecting data that’s too personal.

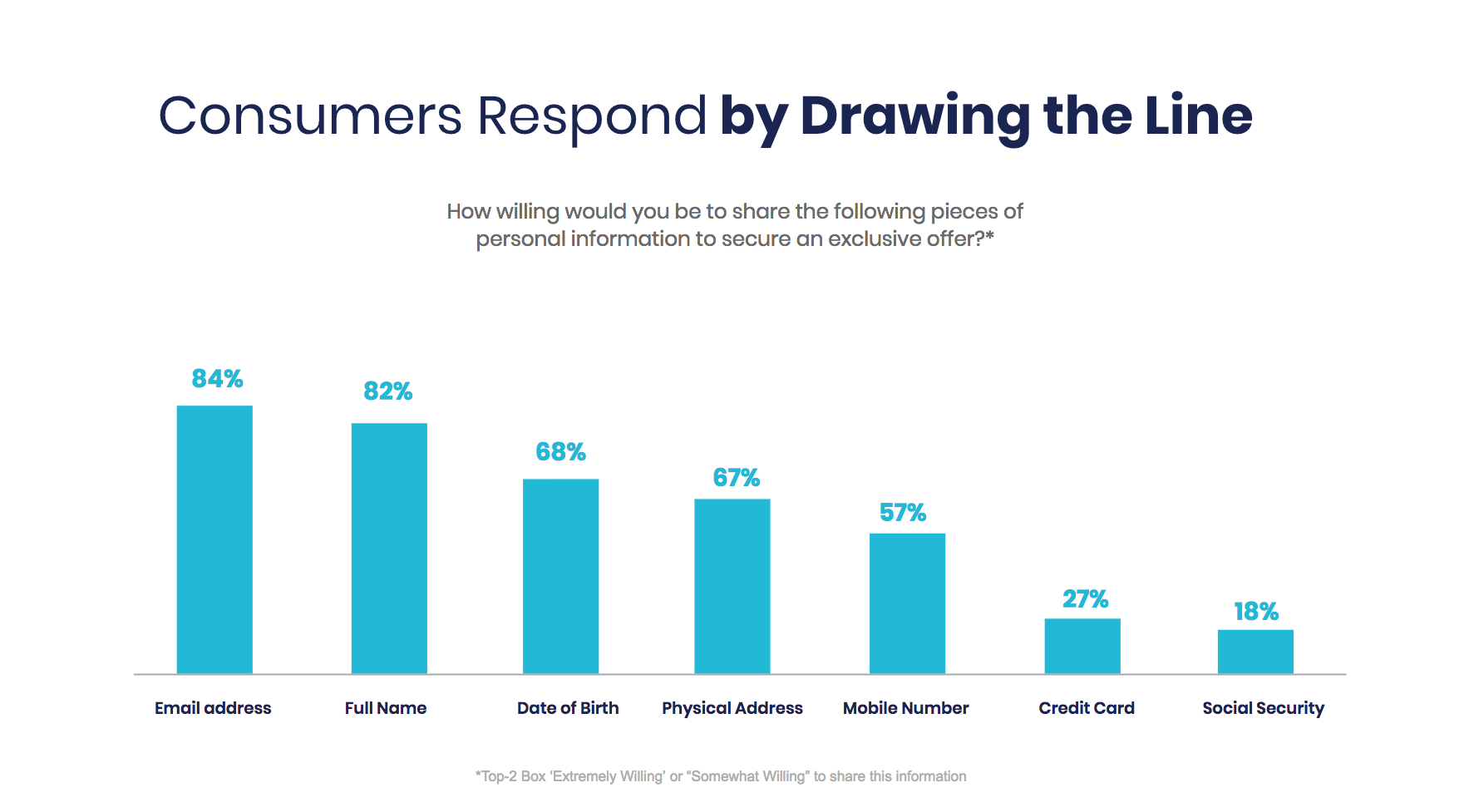

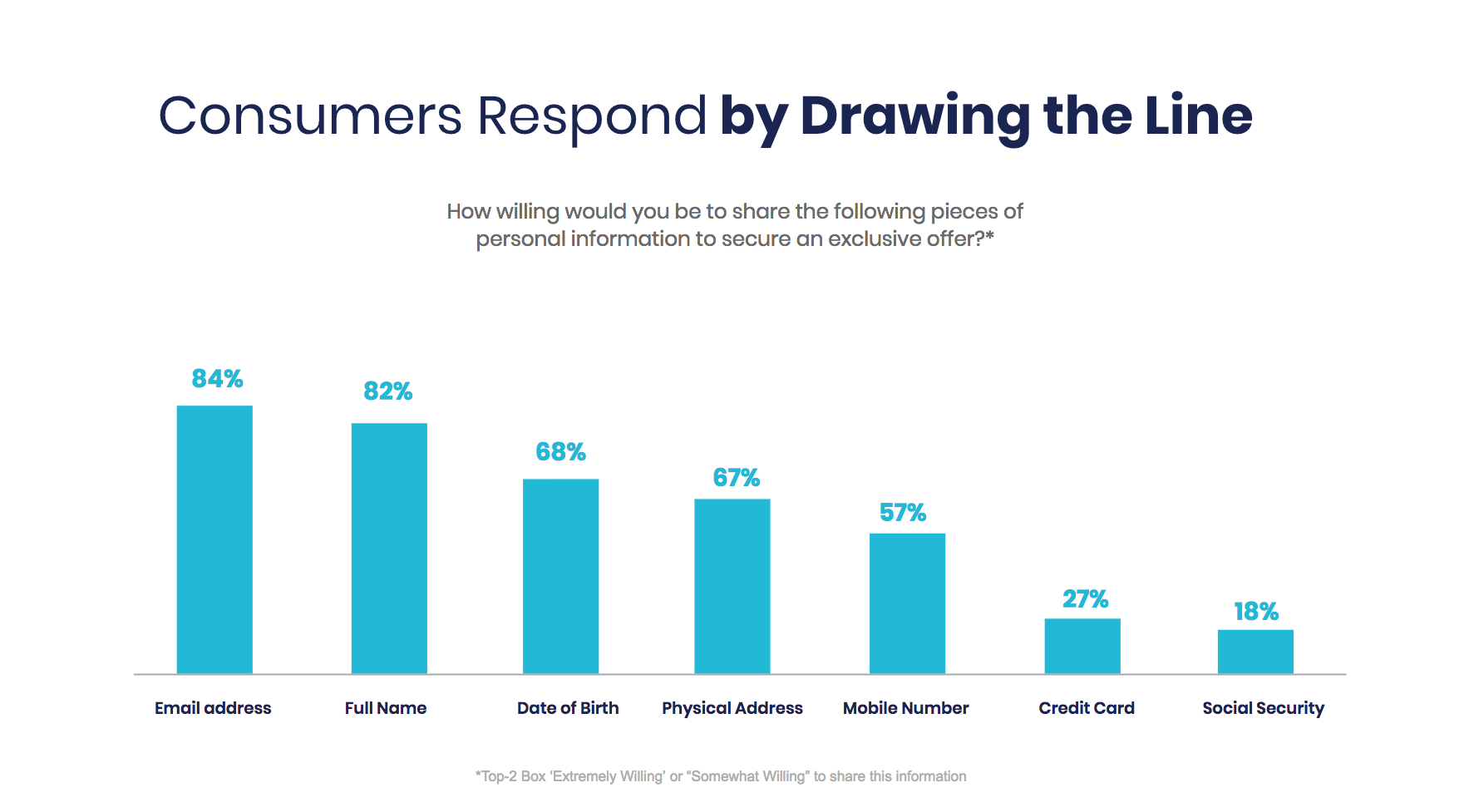

Consumers are reluctant to provide too much data or data that’s too personal. While it’s almost universally acceptable to provide name and email, as age increases, so does the desire to protect very private data like social security number.

Far fewer boomers than millennials are extremely willing to share their social security information (1% vs. 14%), credit card information (3% vs. 14%), or mobile phone number (12% vs. 27%) to be verified for an exclusive offer.

One of the reasons that Digital Verification is so effective is that it uses authoritative data sources to verify eligibility for exclusive offers. You can be confident in a verification process that’s accurate and reliable, and shoppers can opt-in to the discounts they want without sacrificing the personal data they hold dear.

- Have a third-party verify eligibility.

Third-party verification may be the perfect remedy for privacy concerns. Most Americans (57%) would rather be verified for an exclusive offer by an independent third-party than a brand’s customer service representative.

Recent data breaches may explain why. Our consumer survey revealed that more than half of Americans (51%) worry about the security measures being taken to keep their personal data safe. Even when shoppers purchase from a brand they trust, knowing that verification is handled by a third-party expert helps them feel their data is more protected.

Shoppers also know how prone exclusive offers are to fraud as they’ve likely perpetrated it themselves. Over 59 million Americans have redeemed an exclusive offer when they knew they really didn’t qualify, most often through using a code or link forwarded to them by a friend. Third-party verification can boost consumer confidence that an exclusive offer is truly exclusive.

Digital Verification Benefits Shoppers and the Brands that Use It

Consumers are loud and clear with their preferences: only brands that respect the privacy of their data will win their business. Digital verification minimizes the amount and type of data consumers need to provide and offers assurance that their data is more protected.

But it’s not only the shoppers who benefit. Brands delivering exclusive offers protected by digital verification have reported 10x increased conversion rates, 3x repeat purchases, 46% increase in new customers and ROAS as high as 20:1.

With digital verification from a third-party, exclusive offers become a win-win – a way to get the privacy piece right without sacrificing personalization.

For more insight into privacy concerns and consumer behavior, you can download our 2018 Shopper Study: Personalization, Promotions & Privacy.