Marketing to students can be a lucrative strategy for financial services organizations. In the US alone, college students have $574 billion in spending power. And capturing their business early can pay off. Research shows that college students have a 10-year customer life cycle.

What college students often don’t have, however, is a FICO score or credit history. And that makes lending to them risky.

Deserve, a leader in student credit cards, found an innovative way to help mitigate this risk: digital verification.

Deserve Looks at the Big Picture When Marketing to Students

Deserve’s mission is to provide “fair credit for the next generation.” To fulfill this promise, the company looks past traditional credit scores, and instead uses a proprietary algorithm to assess a person’s education, future employability, and current financial health.

The goal is to predict their future credit potential and determine risk. While these are important factors, Deserve must first and foremost verify that an applicant is, indeed, a current student. And for that, Deserve turned to digital verification.

Using Digital Verification to Mitigate Risk

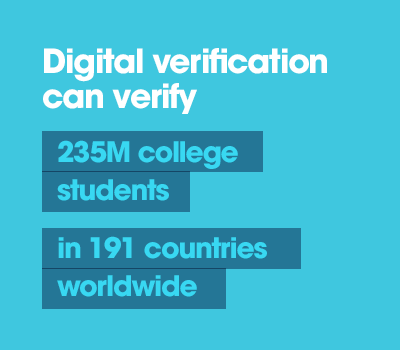

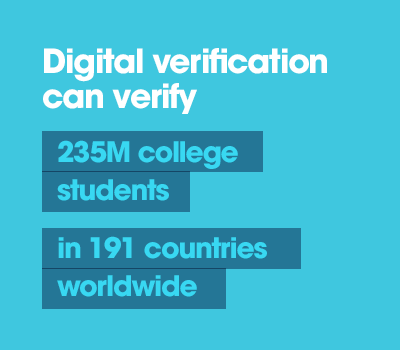

Deserve’s decision to use digital verification to verify students was a smart move. The process provides 100% coverage for the 235 million US and international college students in 191 countries. It also provides additional benefits to both Deserve and its student applicants.

In-Brand and User-Friendly Experience

Deserve integrates digital verification directly into its application process. No social security number is required. Students simply enter their name, school, and date of birth, and they are instantly verified. The process is frictionless, easy to complete, and occurs entirely within Deserve’s brand.

Streamlined Process for “Up-Front” Verification

Simple, customizable forms enable Deserve to create a streamlined customer experience, enhancing their customer “pull” strategy.

Ongoing Protection

Digital verification gives Deserve the ability to reverify a student’s status at any time.

Optimizing Conversions

With digital verification, Deserve can re-engage students who don’t complete their application using email and SMS. This is a highly effective strategy. Brands we work with report that re-engaging customers with SMS messages increases purchase conversions as much as 50%.

Building Loyalty

Deserve can continue marketing to students after they’re approved, nurturing them into long-term customers of Deserve’s other financial products.

Ensuring Compliance

Verifying and documenting college student status helps Deserve remain compliant with applicable banking and lending regulations. Digital verification is always done with consumers’ consent, and we use top security encryptions to secure privacy.

Why Marketing to Students with Personalized Offers is Smart

Research shows that personalized offers implemented with digital verification motivate students. More than 90% of students say they would be more likely to shop with a brand that provides them with a gated, personalized offer.

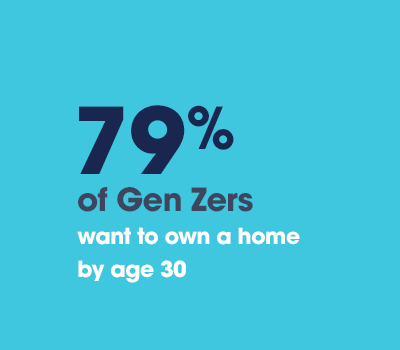

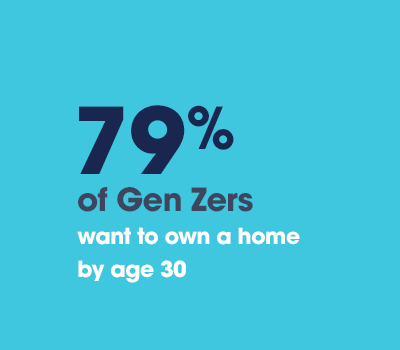

Personalized offers are also a terrific way for financial services organizations to reach Gen Z. Consider this: 79% of Gen Zers want to own a home by age 30.

Financial institutions that approve Gen Zers for a student credit card now help them establish the credit history they need. And digital verification gives those organizations data they can use to remain top of mind with Gen Zers until they’re ready for a home loan.

Join SheerID at Money 2020, October 27 – 30, 2020. Visit us at booth 3204 to learn how we can help your company acquire new customers.