Like many industries, banking underwent a massive digital transformation during the Covid-19 pandemic. In April 2020 alone, there was a 200% increase in new mobile banking registrations and an 85% rise in mobile banking traffic. William Demchak, Chairman and CEOof PNC Bank, describes it as a ten-year shift in consumer behavior that occurred in two months.

The transformation is sending shock waves through financial service organizations.

Financial marketers are racing to meet increasing consumer demand and aggressive company goals for acquiring new digital customers, while also trying to bring down the cost of acquisition for a new account, which—including credit checks—averages $500.

Meanwhile, risk management teams are confronting greater potential for fraud and the need to ensure that new digital accounts are at low risk for default. But incorporating fraud and risk management requirements can add significant friction to the customer experience, and often leads to avoiding or abandoning online applications.

So how can marketers create cost-effective digital banking customer acquisition strategies that risk management teams will approve of?

One solution lies in identity marketing: a new approach in which banks target prospects who belong to specific consumer communities—like students, first responders, and the military—and then instantly and digitally verify them during the online application process.

How Identity Marketing Helps Banks Engage New Customers

With identity marketing, banks can acquire new customers with personalized campaigns that are based on powerful identity attributes, such as a consumer’s life stage or profession. By providing personalized offers to groups like students or the military, banks can reward customers for meaningful aspects of their life and forge deep relationships with specific communities.

And by digitally verifying prospects with a platform like SheerID, financial marketers can instantly and inexpensively confirm a new customers’ identity—including their name, address, phone number, date-of-birth, and social security number.

Banks can also verify consumers’ current employment and membership in the targeted community, which provides even greater customer insight and can lower risk.

How Identity Marketing Lowers Digital Banking CAC

Identity-based offers help banks reduce CAC by creating strong emotional connections with consumers. When customers receive an exclusive offer based on their profession or life stage, around two-thirds report feeling “valued” or “thankful”, which makes a brand stand out.

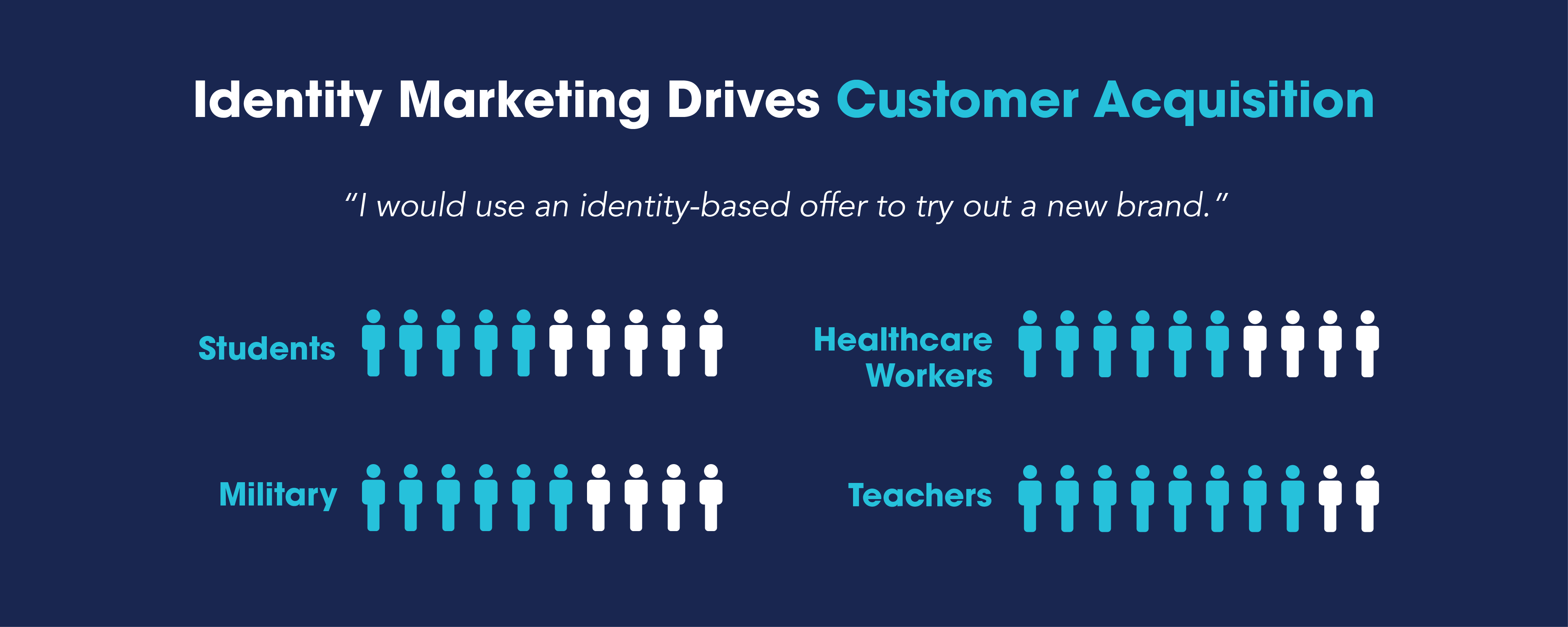

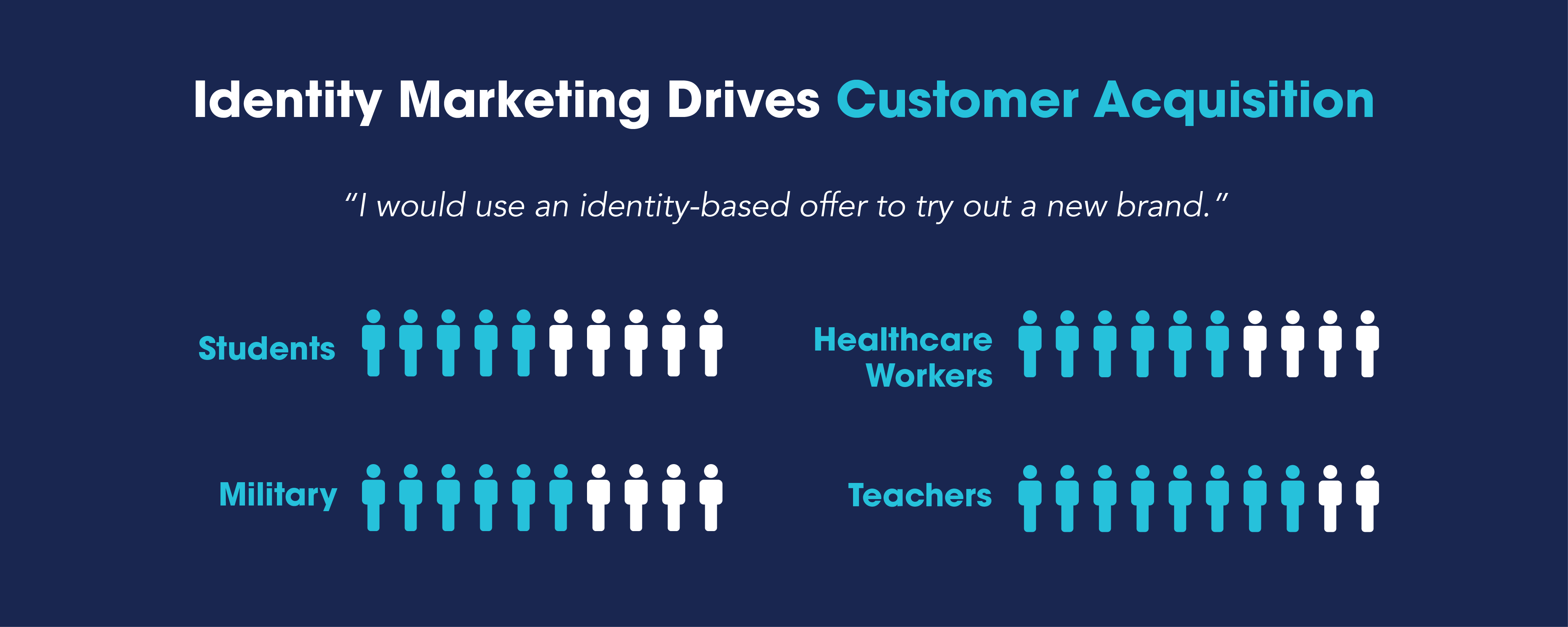

These emotions also motivate buying behavior. Half of students, 59% of the military, 60% of healthcare workers, and 80% of teachers will use a personalized offer to try out a new brand.

Personalized offers also drive brand loyalty. Fifty-nine percent of healthcare workers, 61% of the military, and 69% of students said an identity-based offer would make them transact with a brand more frequently. And in the financial services industry, which has a 15% average annual attrition rate, reducing churn can lead to a significant impact on revenue.

Identity-based offers also reduce acquisition costs because these consumer communities have strong networks and generate powerful word-of-mouth. Research shows that more than 90% of students, teachers, and the military would share a personalized offer with others who were eligible for it.

5 Ideal Consumer Communities for Digital Banking

Identity marketing campaigns enable financial marketers to strategically target the following lucrative, low-risk customer groups.

Military Families

Across the United States, more than 40 million members of the military community possess $1.2 trillion in spending power. With a relatively high average family income of nearly $89k per year, military families have the lowest home foreclosure rate out of all U.S. prime loan customer segments.

And in 2019, 4.2 million military members held security clearances that required maintaining low debt and average-to-high credit scores. Nearly 3 in 4 members of the military actively seek out brands that offer military promotions.

First Responders

There are 2.3 million first responders in the US, including emergency medical services, firefighters, and law enforcement officers. Together, they have $91 billion in spending power and an average FICO score of 692.

These crucial roles often come with credit requirements for entry and continued service. For example, most federal, state, and large municipal police departments require credit checks, disqualifying applicants with low scores and credit defaults. Ninety-nine percent of first responders want to hear about personalized offers designed for them.

Gen Z Students

The majority of the 20 million-plus full-time US college students belong to Gen Z—a group expected to have 33 trillion in spending power by 2030.

According to Business Insider, the average FICO score of Gen Zers is a respectable 674. But even when younger students are invisible to credit bureaus due to their lack of history, SheerID can confirm their identity, student status, and employment, if they’re working.

Capturing Gen Zers is especially profitable because they are just beginning to form brand relationships that can last a lifetime.

Healthcare Workers

With an average annual salary of $242k, physicians are some of the most reliably high-earning and credit-responsible professionals in the US. Their average FICO score is 700.

And while they may not be quite as highly paid, the four million nurses in the US maintain $286 billion in spending power. They have an average FICO score of 702, and in some states they earn more than $100k annually. Ninety-nine percent of nurses want to hear about personalized rewards.

Specialty Employment Groups

With identity marketing, you can target any professional community that fits within your customer risk profile, such as real estate, finance and accounting, and public administration professionals.

For example, other financial services professionals often have very low risk credit profiles, including accountants and financial advisors, who have an average credit score of 720 and 750 respectively. Most financial advisors must also pass FINRA Rule 3110 that requires advisory firms to complete background and credit investigations prior to hiring.

Laser-focusing on these specific groups with personalized campaigns can lead to higher conversion while prioritizing risk reduction from the outset.

How SheerID Can Help You Acquire Profitable Digital Banking Customers

Digital-first banking may have been accelerated by the pandemic, but it’s here to stay. Now is the time for building an easy-to-implement, personalized marketing strategy to reach profitable, low-risk customer groups.

SheerID’s Verification Platform instantly and digitally verifies consumers using more than 200,000 authoritative data sources. This ensures that only eligible members of the community you’re targeting can redeem your personalized offers.

And because SheerID is a customizable, white-label solution, you can seamlessly integrate it into your online application process for a fully in-brand experience. This reduces friction, increases conversions, and creates a positive connection with your new customers.