If you’re like most retailers, you struggle with receiptless returns. You probably collect driver’s license data, and may even have a predictive analytics solution to help determine how likely it is that a shopper is making a legitimate return.

But at best you’re stopping return fraud only after a certain amount of it has already occurred. Most analytical solutions can’t stop fraudulent returns until they’ve happened multiple times. Plus, savvy fraudsters know retailer’s return limits – the frequency of returns allowed in a specific time period – and will simply use a new fake ID to continue the fraud undetected.

Receiptless Return Fraud is a Growing Concern

Loss prevention departments are getting squeezed. Inventory shrinkage is trending higher but there’s not enough money or resources to address the issue. According to recent research, 23% of retailers are seeing a shrink rate of 2% or greater, yet two-thirds of loss prevention budgets are flat or declining.

To make matters worse, the average cost per shoplifting incident has doubled to almost $800; employee theft is higher still at nearly $2,000 per incident; and organized retail crime continues to be a large and growing problem.

Liberal policies for receiptless returns are exacerbating the issue. Their convenience may please customers, but it also makes retailers vulnerable.

Fraudulent receiptless returns cost brands – $9.7 billion annually, and increasingly sophisticated criminal tactics are likely to push the losses higher.

Brands need a solution, but the problem isn’t their flexible return policy. It’s the lack of customer verification.

Verified Returns: What Are Your Options?

According to NRF, 73% of retailers require an ID to perform a merchandise return without a receipt. Typically the driver’s license data (DLD) is recorded and used to enforce return policies, but solutions that effectively verify DLD authenticity are rare. Is the customer presenting a valid driver’s license, or using a fake ID to perpetrate fraud?

In many cases, employees are responsible for assessing the legitimacy of merchandise returns and whether the returns comply with stated policies — a process that’s highly subject. They may even need to obtain management approval before accepting a non-receipted item. These frontline employees typically aren’t trained in this level of customer service, and are often uncomfortable having to deny a return without an automated system that guides their actions.

Another option for retailers is return optimization software that collects data on the transaction history of consumers and employees, and uses predictive modeling to determine the likelihood of fraud. However, these systems are expensive and difficult to implement. And as with any rules-based system, as soon as you change the parameters – e.g. numbers of returns allowed or types of items returned – savvy fraudsters find ways to work around it.

While retailers have relied on a mix of internal and external solutions to identify and prevent fraudulent returns, these approaches come at a cost. You end up sacrificing customer service or fraud protection, or even both.

What if you could identify a fraudulent return when it was taking place and prevent it from even happening?

A New Approach: Digital Verification

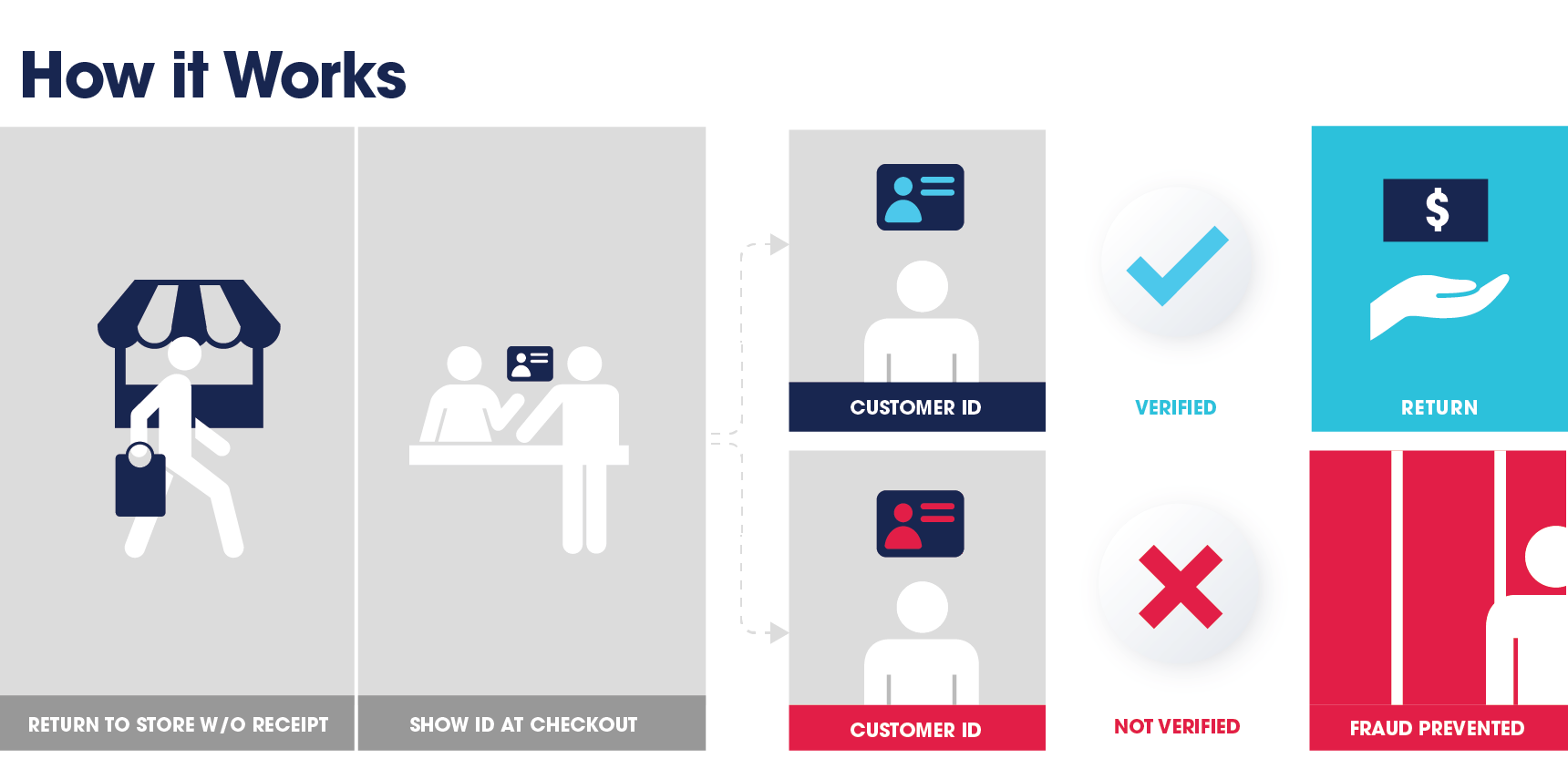

Digital Verification is emerging as the most cost effective and reliable way to proactively prevent receiptless returns fraud and eliminate friction in the customer experience.

With Digital Verification, you can immediately determine if a driver license or other state-issued ID is valid because the verification takes place during the transaction. This eliminates the need to review a shopper’s transaction history, and spares employees having to refuse a return for reasons they can’t substantiate.